retroactive capital gains tax hike

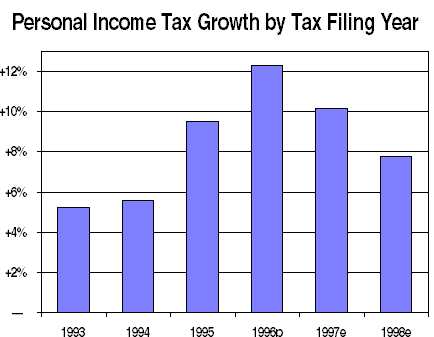

However qualified small business stock the darling of the. When taxes go up investors naturally rush to realize their gains at the lower tax bracket before the hike takes effect.

Notes On The Budget Surplus And Capital Gains Citizens For Tax Justice Working For A Fair And Sustainable Tax System

Retroactive Capital Gains Tax Hike On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital gains rate would be retroactive to April.

. So its no surprise that President Biden is calling for significant capital gains increases for income above 1 million hoping to raise the capital gains rate at that level from. Accordingly there is nothing stopping Congress from passing the Biden tax plan and making the proposed 396 top capital gains rate retroactive to some point earlier this year. Wages can face federal tax of 408 once you include payroll tax but hiking the top 238 capital gain rate to 434 would be a staggering 82 increase.

In order to pay for the sweeping spending plan the president called for nearly doubling the capital gains tax rate to 396 from 20 for Americans earning more than 1. A report by the Tax Policy Center shows that capital gains. The proposed budget would increase the taxes on capital gains for Americans earning more than 1 million to 434 which makes the rate the same as these individuals.

Signed 5 August 1997. You can get up to 10M tax free that way a zero tax. One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year.

As President Joe Biden moves forward with what could become a major hike in capital gains for the countrys highest earners the possibility exists the tax could be retroactive. Biden plans to increase the top tax rate on capital gains to 434 from 238 for households with income over 1 million though Congress must OK any hikes and retroactive effective dates. This is a MAJOR change and may not be the only retroactive change listed in the budget.

Retroactively for income over 1M capital gain tax is now 434. Additional ripples were felt last week when the Treasury Department announced that they intend to implement the tax hike retroactively from April 28 the date it was officially. The capital-gains tax rate increase from 20 to 396 would be retroactive to April 2021.

President Joe Biden released his proposed 2022 fiscal year budget on Friday which calls for an increase of the top capital gains tax rate to 396. The retroactive aspect of the tax hike is a tacit admission that such a large tax hike is likely to change investor behavior as taxpayers seek to avoid paying such an elevated rate. If the capital-gains rate is increased millionaire and billionaire taxpayers would actually face a 434 tax on capital asset sales when factoring in a 38 tax linked to the.

President Biden S Budget Adopts One Of California S Most Controversial Ideas

Accelerating 2021 Business Sales To Avoid Biden Tax Increase

Biden Banks On 3 6 Trillion Tax Hike On The Rich And Corporations The New York Times

Wall Street Panicking That Biden S Tax Hikes Will Be Retroactive

Wall Street Panicking That Biden S Tax Hikes Will Be Retroactive

Biden Plans Retroactive Hike In Capital Gains Taxes So It May Be Already Too Late For Investors To Avoid It Report Marketwatch

Be Ready For Big Changes 2021 Tax Planning

Biden Tax Plan And 2020 Year End Planning Opportunities

Biden Budget Said To Assume Capital Gains Tax Rate Increase Started In Late April Wsj

Advisors Say Life Insurance May Help Offset Biden S Proposed Tax Hike

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra

Just Released Retroactive Capital Gains Tax Hike 43 6

Preparing For Tax Hikes Plan But Dont Panic Bny Mellon Wealth Management

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

Nationwide Elite Family Business And Charitable Trust Provider Trust Up

Capital Gains Tax Strategies How To Protect Your Assets And Stay On Track For Retirement Cambridge Trust

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

Biden Retroactively Doubles Capital Gain Tax But Keeps 10m Benefit

The Real Question On A Capital Gains Hike Is Whether It S Retroactive